In this post I am going to show you how you can use an effective tool to improve your business no matter how big or small it is.

In this post I am going to show you how you can use an effective tool to improve your business no matter how big or small it is.

And I will show you mistakes that some of the biggest companies make so you know what to avoid.

Why incentives?

Using incentives for influencing staff to make the right decisions to ensure the profitability and effectiveness of the business is a well established practice.

In fact it can be considered equivalent to the practice a nation’s central bank has of manipulating the interest rate to manage the economy.

This is equivalent because the interest rate is an incentive to people within an economy. An incentive to borrow and spend or to save and invest.

But incentives are very much a blunt weapon. They are not accurate or specific. Incentives set a general direction but not a specific outcome. This is important to remember in the context of incentives for businesses.

What to avoid

The first mistake that many businesses make is not ensuring that the incentive is properly linked to the bottom line. This is often then compounded as businesses over-correct when they see outcomes that they don’t want. Economists have learned that rapid or significant changes in interest rates to manipulate the economy can be dangerous, which is why you see central banks take a slow and conservative approach. But this is a lesson that most businesses have not yet learned.

One of the largest corporations in NZ, implemented a change in incentives a few years back to really focus on the customer experience. At that time the company was strong on financials but had a poor reputation in the marketplace, and competition was looming.

The change in focus of incentives made it’s impact. Because bonuses were based on Customer Experience, managers throughout the organisation focused on what they could do to help with this, and the organisation underwent a transformation in the marketplace that surprised many.

But it isn’t all good news.

The incentive program was not aligned to profitability. So while the company has made impressive gains in customer satisfaction, and preference, it has done so while profits have declined.

Unfortunately it looks as if the issue will now be compounded. Because the management recognising the issue of not addressing profitability in their incentive structure, have made a change. Ignoring the lessons of economics they have instigated a radical change to profitability and totally dropping the focus on Customer Experience.

Getting it Right First Time

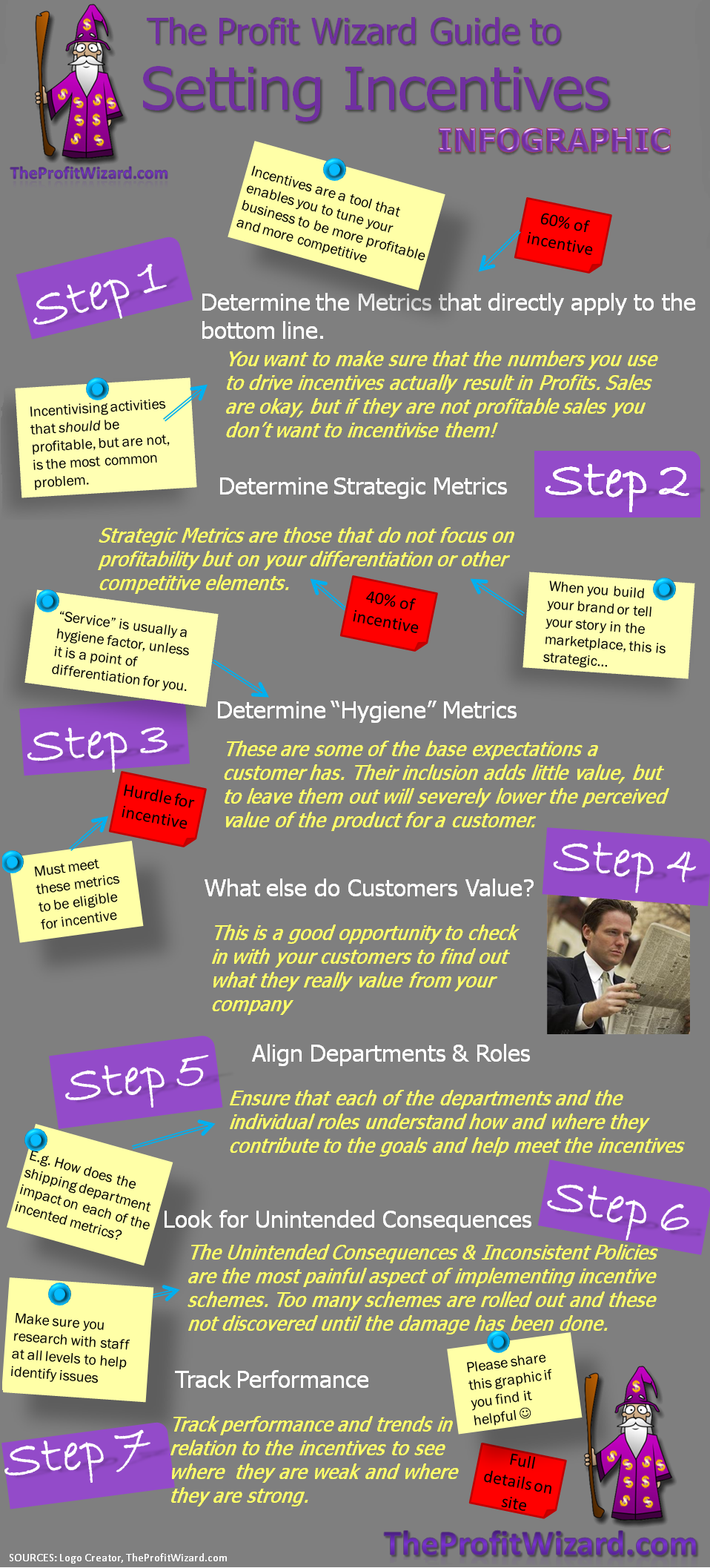

There is a major lesson here. Below you will see in my Incentive Guide, that there are two primary factors you want to include in any incentive plan. The first is profitability. -Don’t take it for granted, this is critical. The second is your strategic consideration. Often this will be your competitive edge or your point of differentiation in the market place.

For example Disneyland is well known for it’s cleanliness. This trait is not directly related to profitability, but is certainly an aspect of their strategy and differentiation from other amusement parks. Now I don’t know that they have metrics for measuring cleanliness, or if those metrics are reflected in staff incentives… But I will be very surprised if they don’t.

Unintended Consequences and inconsistent polices are a real problems for businesses implementing incentives. Unintended Consequences are often due to not linking the incentivised behaviour through to every role or department, or linking it through without much thought.

It is also worth remembering that most businesses will incentivise different departments in different ways. The sales force  will usually have a direct incentive based on the sales they generate, but it is important that the whole organisation are incentivised on the same goals. Alignment between the wider organisation, and the sales force is the one area that I see the most misalignment.

will usually have a direct incentive based on the sales they generate, but it is important that the whole organisation are incentivised on the same goals. Alignment between the wider organisation, and the sales force is the one area that I see the most misalignment.

Another Warning Example

A much larger Multi-National corporation (a household name) has this problem with their incentives, at least in New Zealand. They sell high end technical goods and services to corporations and businesses. They have linked their incentives to sales for the sales staff by way of a commission. However due to some poor policy they have set it up so that the full commission is paid to the sales staff regardless of any discount the sales staff puts on the products or services they sell.

This ludicrous situation has resulted in sales staff routinely, almost automatically, offering discounts both on the hardware they sell and the support contracts that go with them. There are no consequences for the sales staff in discounting, as they get full commission. The consequences on the business are significant as their cashflow and profitability is suffering.

Therefore to get you started on the right foot I have put together…

The Profit Wizard’s Guide to Incentives

Step 1: Determine your key metrics that correlate to profitability for your business. Incentivise these for about 60% of the incentive

Step 2: Determine your strategic elements and key metrics for those. Remember these will be things like your competitive advantage or point of differentiation. They will be things that have not shown up as being directly linked to profitability in step 1. Incentivise these things for about 40% of the incentive.

Step 3: Determine the hygiene factors of your business. Abraham Maslow coined the term ‘hygiene factors’ in his study of motivation. For example The staff might lose morale if the bathroom facilities are not pleasant or maintained. But after they reach a certain standard, increasing the level of cleanliness above that standard will not increase their morale.

What are the hygeine factors for your customers? A certain level of standard is expected. If you fall below that you will start to lose business. Above that it will not gain you anything (unless it is a point of differentiation which then belongs in the previous step).

Once you have your hygiene factors determine some metrics you can track. Make these metrics a hurdle for your incentive program. -These minimum standards must be met by individuals, departments or the business at large, in order to be eligible for any incentives. Note that the hurdles can be tiered so that meeting 80% of hurdle will grant 50% of incentive; 90% = 75% bonus; and 100% = 100% or something similar

Step 4: What else do your customers value? This step is really a check. You want to make sure that you are not missing anything, because you don’t want to over-correct if you start off on the wrong foot. Take the time and check your assumptions in the marketplace. Ask your customers and prospects.

Step 5: Align departments and roles. You will now have an overall set of business metrics. This is what you can use for managers and senior staff. Next you want to see how you can implement the metrics for each department to get the department aligned with the goals of the company. Finally you want to look at the individual level to see what incentive should link to their output or KPI’s (Key Performance Indicators).

Step 6: Now you have your plans in place look for the unintended consequences or inconsistent policies in what you have put together. Consider getting some of the staff to look them over and feedback what that might mean in terms of how they will work. Be hyper aware of opportunities of the staff to ‘game the system’ using the rules you have put together.

Step 7: Track and monitor performance. Obviously you will be tracking the metrics to apply the incentives, but you must also track the performance of the incentive program. How has it influenced the metrics? Does it have the impact you wanted? What trends are you seeing good and bad? Is there anyway that the bad trends could be linked to the incentives scheme.

You should have an incentives register where you collate this data on a regular basis, and where you can also add insights. This register will allow you to fine tune and shift the balance of your incentive program on an annual basis.

Feel free to share the infographic below if you find it useful.

(click on the image a couple of times to enlarge)